It has fallen by 80%, and the test of good shops has just begun.

Author: Xiao Li Fei Dao, editor: Xiao Shimei

In November, 2023, Yang Yinfen, the new head of Liangpin Store, wrote in an open letter to all employees that the company is facing the most difficult challenge since it started its business, not only the problem of living hard, but the problem of not being able to live. If it remains unchanged, it is really possible to lose the opportunity at the poker table.

This is really not an alarmist.

[Strategic Turn]

At the end of 2023, Liangpin Store officially announced that the average price of more than 300 products of the company was reduced by 22%, with the highest drop of 45%, the largest price reduction in 17 years. This means that good shops have given up the positioning of high-end snacks, and their business strategy has turned to the pursuit of "cost performance".

In fact, in the past many years, the company’s high product prices have not brought higher profits to the brand, but have discouraged consumers and increased business pressure.

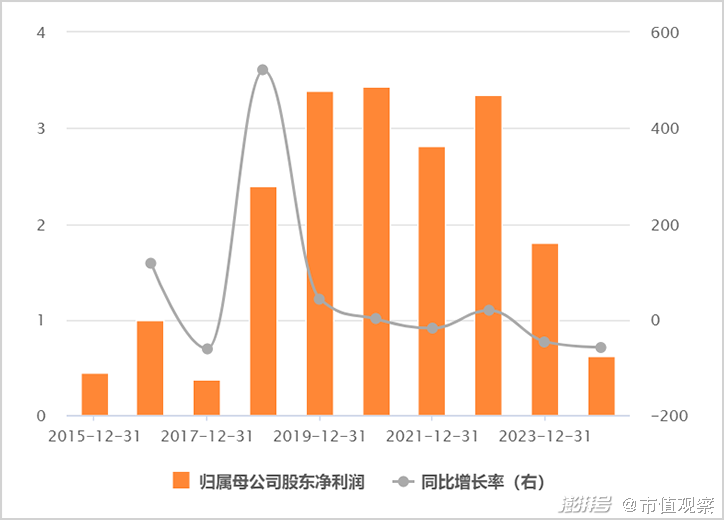

Since listing, the revenue of good shops has almost stagnated, and the profit has been negative. In 2023, the revenue was 8.046 billion yuan, down 14.76% year-on-year, and the net profit returned to the mother was 180 million yuan, down 46.26% year-on-year. In the first quarter of 2024, it continued to drop sharply by 58%.

▲ source: Chocie

The profitability of good shops is also deteriorating. The gross profit margin in the first quarter of 2024 was 26.43%, a sharp drop of 6.3% compared with 2015, setting a new low since the financial disclosure data. The latest net interest rate was 2.54%, down 1.59% from 2019. Among them, the sales expense rate is around 20% all the year round, but the R&D expense rate is less than 1%.

Judging from the above core business data, the high-end business strategy of Liangpin Shop has not brought good growth to the company. However, after the strategic shift, the future life is still difficult, because there will be a big price cut.

For good shops, it will be a good result if the price reduction can achieve small profits but quick turnover. But often the ideal is full, and the reality may be very skinny.

In recent years, discounts on leisure snacks have become a common practice. Not only are good shops cutting prices, but three squirrels, herbs and other heads are lowering their bodies to cut prices, not to mention many small and medium-sized brand manufacturers following suit. You drop me, but the total demand of consumers will not change obviously, so the final outcome of price reduction is that it is difficult to make up the price by quantity.

Three squirrels are a typical example. At the beginning of 2023, the company put forward the strategy of "high-end cost performance" and carried out quality improvement and price reduction. However, the total annual sales volume was 68,500 tons, which was 12% lower than that in 2022.

Secondly, the price reduction of good shop products will reduce the company’s gross profit and net profit performance, impact investors’ expectations, and the overall valuation level may tend to move down.

Judging from the advantages and disadvantages of the business model, the leisure snacks where Liangpin shops are located are at the bottom of the whole food and beverage, with low operating threshold, easy price war, rapid changes in consumer demand and low brand loyalty. Unlike high-end liquor, it has high operating barriers, and can continuously raise prices, improve profitability, and the valuation level is often relatively high. In other words, good shops are in a bitter business track, earning hard money.

Good shops don’t cut prices, so it’s difficult to operate! After the price reduction, it may be more difficult to operate!

[Industry changes]

In the past many years, high-end snack enterprises have been competing for market positioning, with good shops, three squirrels and herbs everywhere. Nowadays, the giants are forced by reality to cut prices to survive.

In addition to objective factors such as macro-consumption fatigue, the most important logic is the rapid rise of the snack mass-market store model focusing on cost performance in just a few years, which reshapes the market structure of China leisure snack industry.

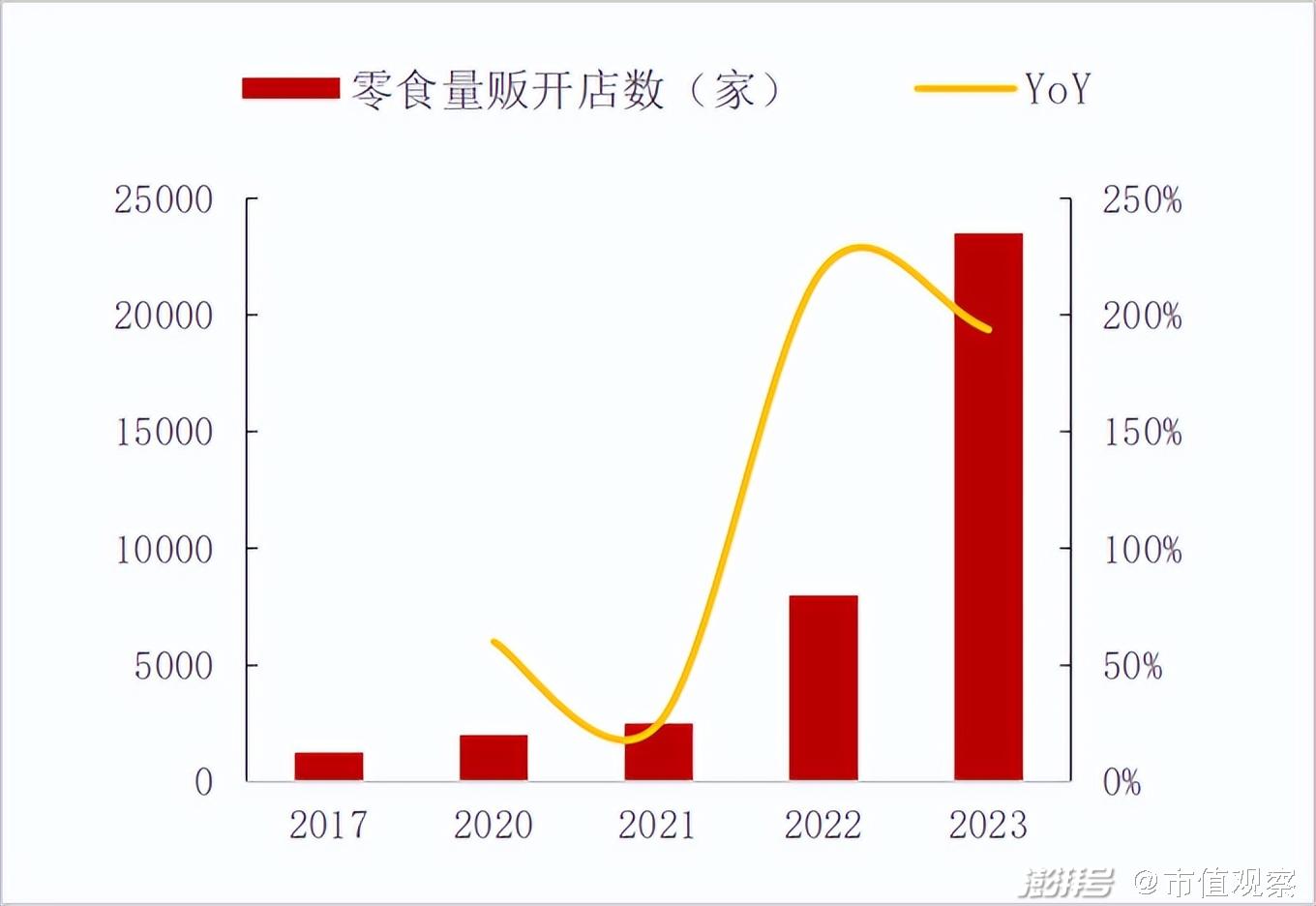

From 2021 to 2023, the number of snack discount stores in China increased from 2,500 to 25,000, an increase of 1,000%. It is estimated that it will exceed 30,000 in 2025, and the compound annual growth rate will still exceed 30%. The sales scale increased from 3.7 billion yuan in 2017 to 70-80 billion yuan, with a compound annual growth rate of 112%.

▲ The number of snack shops has expanded rapidly. Source: Dongguan Securities.

After several years of staking, the snack discount market has basically formed a market pattern of "North Wanchen, South Busy, West Ming and East Ming". Among them, the industry leader Snacks is very busy. The number of stores in the group was only 1,150 in 2021, and it has expanded to 6,500 in 2023, more than five times.

In November, 2023, Snacks Busy merged with Zhao Yiming Strategy. In 2023, the new group’s total revenue exceeded 20 billion yuan, and the number of stores reached 10,000, which brought the snack discount war from regional competition to the whole country and crushed other competitors.

Then, why can snack shops rise rapidly?

According to the words of the semi-annual report of Three Squirrels in 2023, the discount snack format is aimed at the bottom consumption demand of "how fast and how good it is", and it will rise rapidly with more abundant zero food and more affordable product prices, and will efficiently undertake the traffic transfer from traditional supermarkets (PS: accounting for more than 40% of sales channels).

Specifically, for example, snacks are very busy, there are more than 2,000 kinds of snacks in Zhao Yiming, and the monthly renewal rate is more than 100 kinds, and the location is near the community or in the commercial area with more people, which can better meet the needs of consumers.

Of course, the most important thing is the price. Discount snack vendors have innovated the snack channel, that is, bypassing the dealers and purchasing directly from the manufacturers, making profits to consumers with lower purchase costs, and finally getting the return of small profits but quick turnover. According to statistics, the average retail price of general discount snacks is about 20%-40% lower than that of supermarkets. This is attractive enough for consumers.

China leisure snacks sales channels, offline is still the main battlefield, accounting for more than 80%. Now, the rise of discount snack mode is regarded as "offline version of Pinduoduo" by the market, which has had a strong impact on the high-end snack price system, including good shops.

Good products are greatly reduced in price and have to be.

[Difficult situation]

In 2012, Yang Hongchun led a good shop to bet wildly on e-commerce channels, laying out Tmall, JD.COM and No.1 stores, and embarked on the road of rising, realizing the leap from a regional snack brand to a snack industry giant.

In 2015, online sales exceeded 800 million yuan. In 2016-2019, online revenue continued to grow, accounting for 33.7% to around 50%. Relying on the e-commerce dividend, the good shop has surpassed the one that still relies mainly on offline channels.

However, in recent years, the pattern of e-commerce platform has been intensified and reshaped, online traffic differentiation has continued, the channel layout of good shops has been unbalanced, and the online growth engine has failed. In 2022, the revenue of e-commerce channels showed a rare negative growth, which worsened in 2023, with a sharp drop of 32.6% year-on-year, accounting for 10.58% to 39.8% of revenue.

The online channels of good shops rely heavily on Tmall and JD.COM, and there is no improvement in the layout of Tik Tok. However, the e-commerce market in Tik Tok has risen rapidly. In 2023, the sales of leisure snacks surged by 53%, eroding the market cakes of Tmall and JD.COM. Looking at peers, the revenue of Tik Tok platform of Three Squirrels surpassed that of JD.COM platform in 2023, with a year-on-year increase of 119%.

In terms of offline channels, good shops still open more direct stores. In 2023, there were 258 self-operated net stores, and the total number of direct stores reached 1256. In the same period, 191 franchisees closed their stores, leaving 2,037.

I’m afraid that blindly opening a good shop can’t stop the business decline. On the one hand, accelerating the opening of direct stores also means higher operating costs, which is also an important factor dragging down performance. On the other hand, the rise of snack discount mode will divert offline traffic, which will also have an impact on the business of good direct stores.

On the other hand, the competitor Yanjin Shop has a profound understanding of the changes in retail channels. As early as the second half of 2021, it began to lay out snack discount channels, and the partner was the industry leader Snacks Busy Group.

In 2023, Yanjin Shop has exceeded 500 million yuan in the busy snack sales channel, accounting for more than 12% of the total revenue, far exceeding the traditional supermarkets such as Wal-Mart and CR Vanguard. In 2022-2023, the revenue of Yanjin Shop increased by 26.8% and 42% year-on-year, and the net profit returned to the mother increased by 100% and 67.8% year-on-year. Its performance is the best among the listed snack vendors.

Good shops don’t cooperate with the channel of mass-selling giants, and may have some concerns and considerations of their own. First, I want to control the offline traffic entrance by expanding the scale of opening a store, and I don’t want to be an "offline platform worker". Second, we set up a discount brand "Snacks Hard Home" to focus on the Hubei market. It was expected that 500 stores would be opened in 2023, but it did not cause much waves in the market.

Yanjin Shop chose to embrace the general trend of channel traffic change, and got a wave of super bonuses, and its performance scale reached a big step. On the other hand, the decision-making of good shops is somewhat slow and chaotic, and some opportunities are missed. Of course, all this has nothing to do with the lack of company supply chain.

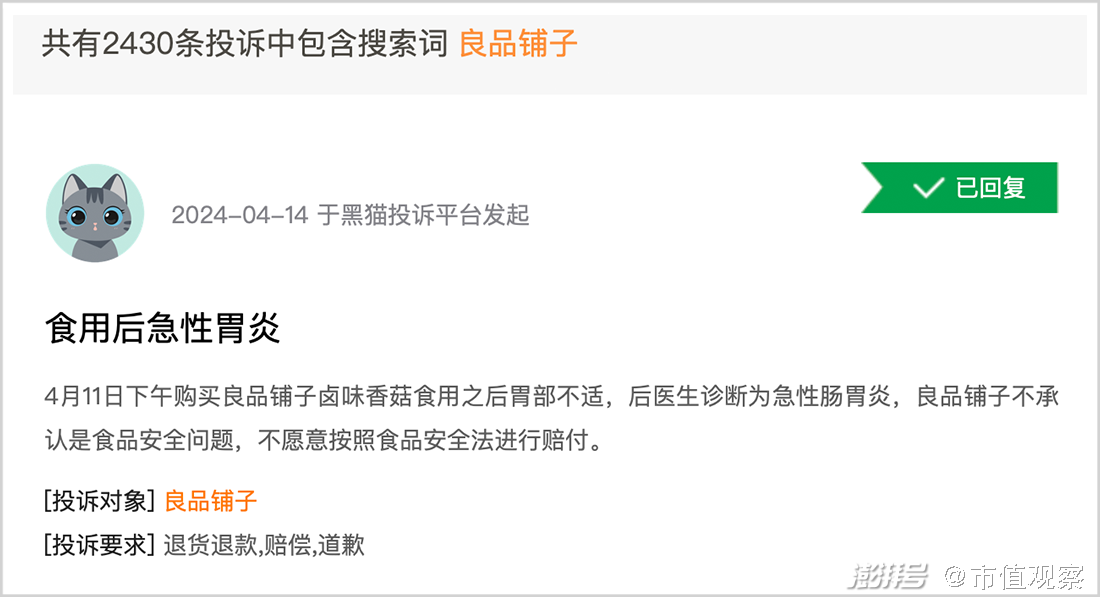

Good shops don’t have their own production factories, and the products take the mode of "OEM+OEM". On the one hand, it is difficult to effectively manage and control food safety and quality. For example, on the black cat complaint website, there are more than 2,400 complaints about good shops, including eating foreign objects and moldy food. On the other hand, it can’t enter the retail scene in large quantities like other self-produced brands.

▲ Source: Black Cat Complaint

Yanjin Shop controls the supply chain by itself, which can control the procurement, production and sales, and can extend the upstream and downstream industrial chains, with good cost reduction effect. Its gross profit margin and net interest rate rank NO.1 in the snack industry, which is significantly higher than that of good shops.

Generally speaking, in terms of online channels, the growth engine that relied on in the past has turned off due to the disappearance of the traffic dividend of the e-commerce platform. In terms of offline channels, no effective measures have been taken to deal with the major changes in traffic, resulting in passive operation. Based on this, the capital market has already voted with its feet. The stock price of good shops has retreated by more than 80% compared with the peak in 2020, and the market value has evaporated by 27 billion yuan.

As a result, Yang Yinfen, the new coach, may have to accept the reality that good shops return to mediocrity, and the era of high growth is gone forever. However, the severe test of the market may have just begun.

disclaimer

This paper deals with the contents of listed companies, and is the author’s personal analysis and judgment based on the information publicly disclosed by listed companies according to their legal obligations (including but not limited to temporary announcements, periodic reports and official interactive platforms, etc.); The information or opinions in this article do not constitute any investment or other commercial suggestions, and Market Value Watch shall not be responsible for any actions arising from the adoption of this article.