The blue word cultural industry reviews above the point pay attention to and star the standard.

"Give you eight minutes, what can you do?" For Tik Tok blogger @ Grey Wolf’s sheep, 8 minutes is enough for her to get rid of a sheep. Recently, the blogger exploded with the video of calling a flock of sheep with crisp noodles and killing a sheep in eight minutes. At present, her fan base has exceeded seven million. The girl born after 00 used the magic of crisp noodles and her "little sheep brother" to open Tik Tok’s "traffic password".

author | Hu Jinyun (cultural industryCommentator, researcher of Sanchuan Huiwen Tourism Research Institute)

read and edit | Time

edit | Peninsula

source | Cultural Industry Review

"Sir, it has been three years since your wife was sent to Xinjiang to herd sheep."

"Will you bow your head?"

"Not yet, but she has successfully led more than 600 sheep and set a record of killing a sheep in eight minutes. People give her the nickname’ Desert Butcher’."

The blogger @ Grey Wolf’s sheep, known as the "Desert Butcher", whose real name is Ran Hui (hereinafter referred to as Ran Hui), was born in 2001 and came to Xinjiang from Shandong with her parents in 2018, so it became an essential part of her life to shuttle through the Populus euphratica forest and herd sheep in the desert. It’s hard to associate Ran Hui with the butcher who slaughters sheep without blinking an eye because of her youthful age and pure face. However, the sharp contrast between the two makes her fans soar all the way, becoming another "top stream" in Xinjiang after Alimu, whose background is too fake.

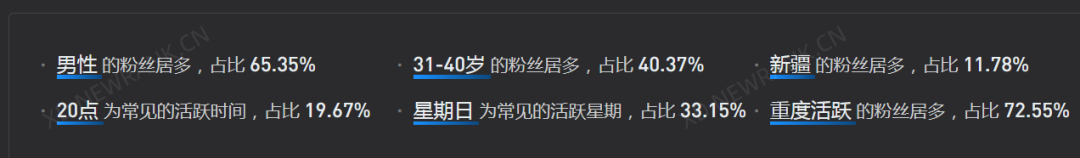

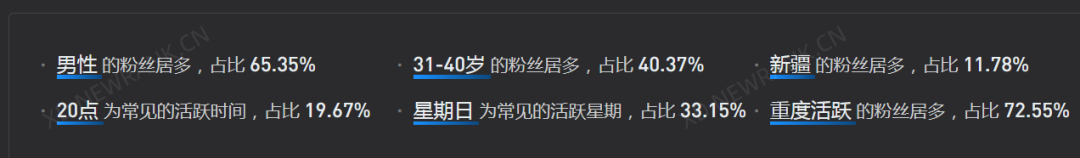

△ Image source: flying melon data

If contrast is the magic weapon to win, but there are not a few videos with contrast, why is she the one who broke the fire? Without him, the weather is right and the people are harmonious.

"Desert Butcher" out of the circle, rough beauty is the most pleasant.

It is not unusual to herd sheep in the desert, but a young girl with fair skin and clean clothes can feed the sheep with instant noodles and kill the sheep within 8 minutes without touching a drop of blood, which is enough to make the spectators stop.

Simple and pure, the perfect combination of desert scenery and shepherd life

In Ran Hui’s video, there are no exquisite pictures and far-fetched people’s designs, but only simple and simple shepherding girls and flocks of sheep and the desert scenery of Bayinguoleng vast expanse.

Ran Hui always stands/sits in front of the camera in a white coat and jeans, with the dusty Gobi desert and sparse and verdant Populus euphratica forest behind him, where sheep roam. When she opens a packet of crispy noodles, the sheep will run towards her and gather together in front of her, and the brave sheep will even bite directly.

In addition to herding sheep, she will also cook belly-wrapped meat in the rough desert, and she will also chew Xinjiang’s big naan with a smiling face. The picture may not be beautiful but it is true enough. This is a portrayal of the life of many shepherds: being with sheep and following the dust, such a life is lonely and lively, and the vigor of youth and the agility of life complement each other, drawing a rough and real picture.

The video is not complicated, but it has natural beauty. The story takes place in Xinjiang. For most people, it is difficult to get close because of the distance. Xinjiang always wears a mysterious veil. At the same time, the life accompanied by sheep all day is too far away from us, which is completely different from the existence of urban life. The combination of "distance" and "psychological distance" makes such content naturally become the distance we yearn for. According to the latest statistics, most fans in Ran Hui are men, with a high proportion of 31-40 years old. These people are carrying the heavy burden of life and may be drowned in the crowd by the current of reality, but it does not prevent them from psychologically escaping from the stressful city and gaining a moment’s peace in the online world.

△ Image source: New shake

There are thousands of people, and being yourself is the best choice.

Apart from the natural content pool of Xinjiang scenery and herding life, one of the important reasons for Ran Hui’s success is that she shows a unique self.

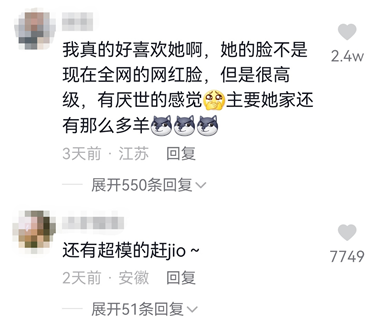

Balzac once said"Genius and beauty are destined to shine brilliantly."It may be exaggerated, but it is reasonable. Ran Hui is undoubtedly beautiful, which is different from the plastic beauties that can be seen everywhere in Tik Tok. Her light makeup gives people the feeling of "naturally carving", and she not only has the beauty of youth in her prime, but also has a sense of indifference and world-weariness.

In recent years, the emergence of "net red face" has caused aesthetic fatigue, and "world-weariness" has been increasingly recognized by the mainstream aesthetic system. The world-weary face looks like it has seen through the world and has a unique decadent beauty. Because it is favored by the fashion circle, we often associate it with "advanced", and the typical representative is the famous actress Mizuhara Kiko. Under such a trend, Ran Hui’s "world-weary face" presents advanced aesthetic feeling, which adds fuel to her explosion, and her attitude of loving life forms a layer of contrast invisibly, thus forming a kind of beauty with sweetness, which attracts a group of fans who love life while attracting face powder.

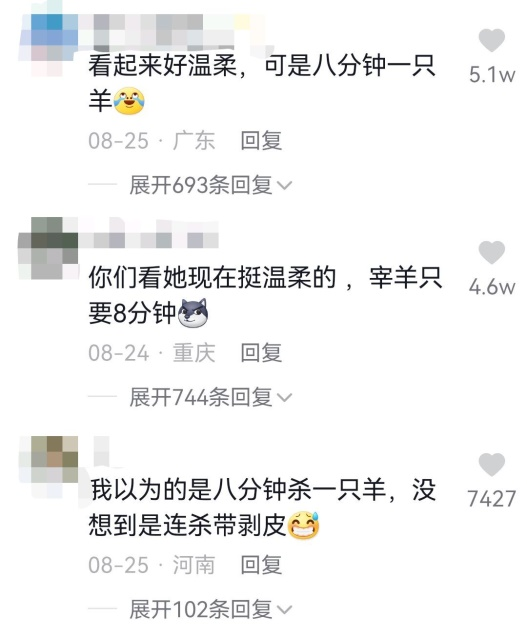

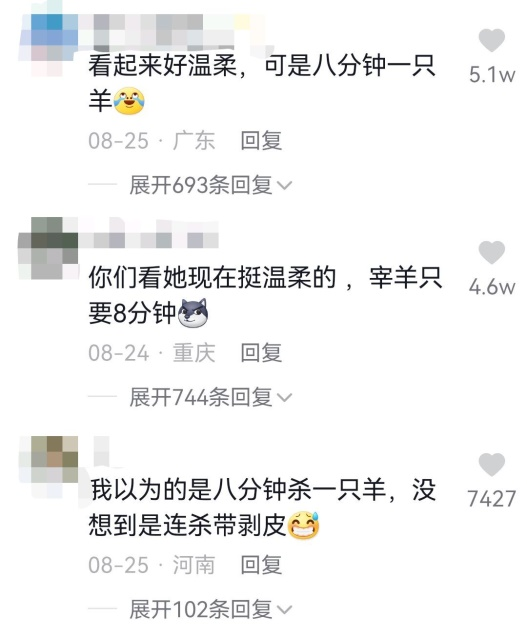

In addition to the handsome appearance, it takes time to explode. As the saying goes, "After ten years of herding sheep, everyone knows about it once." On the occasion of Eid al-Adha, Ran Hui recorded a video challenging a sheep for 10 minutes, but it took only 7 minutes and 33 seconds to complete this "feat". In addition, unlike the traditional sheep, her "little sheep brother" likes to be fed with crispy noodles and biscuits, which are interesting, so her legend is constantly circulating in the rivers and lakes.

Corresponding to the sheep nicknamed @ Grey Wolf in Tik Tok, she is both a shepherd and a "Grey Wolf" in the eyes of netizens. It can be said that this nickname is both popular and easy to remember and close to her position as a "dangerous shepherdess", which has boosted her popularity to some extent.

In the comment area, the word most frequently mentioned by netizens is "eight minutes", which distinguishes her from others. If there is an example for the beauty Ga Yang to follow, her "degree of terror" is further visualized and unforgettable when her skill of slaughtering sheep is quantified with accurate figures. This number has become her exclusive memory point, which not only allows her to find that unique self, but also allows others to find her more accurately.

△ Image source: New shake

Walking with the times, the darling of platform empowerment

The people and things in the video look extremely simple, but it is precisely because of this unadorned simplicity that we are stuck in the traffic in the city.The wind and sand burst, touching our eyes with the desert in the distance. What Huiran shows is an ordinary life, a real life that seems far away but can be implemented, and it has an ordinary and simple beauty.

This real beauty touches us, and it is also in line with Tik Tok’s concept of "recording a better life". Based on its unique positioning, the platform algorithm accurately boosts this "fire". Up to now, Tik Tok has spawned some related hot spots, such as # All-Net Aitega Girl Summons Everything #, # Garga Girl’s Werewolf Appearance #, # Garga Girl’s Desert Show #, # You are not her, and there is no murderous look in your eyes #. She is like a "walking topic maker".

And her video content has become more and more diverse, co-producing with Alimu, connecting with the deputy magistrate of Yuli County, responding to the ridicule of netizens, performing desert catwalks, and showing excellent painting skills. The vertical and colorful content continues to be output, which makes people know more about her, and also spies on the hot land behind her. Ran Hui’s videos are mostly associated with topic labels such as # My Country Life #, # Xinjiang #, # Pasturing Sheep #, # New Farmer Plan 2022#, which is self-evident, and it is a sinking rural area, just in line with the direction of Tik Tok’s vigorous development of the "Three Rural Tracks".

In 2020, Tik Tok launched the "New Farmer Plan", with a total investment of 1.2 billion yuan to support it, and then the plan continued to iterate with the change of years. In February, 2022, Tik Tok released the Tik Tok Rural Data Report, which showed that in 2021, the number of rural-related videos increased by 34.38 million, and they were praised more than 3.5 billion times. On the one hand, it showed that Tik Tok attached importance to the countryside, on the other hand, it also revealed the love of shaking friends for rural themes. In the case that the growth rate of the number of users in Tik Tok is slowing down and the first-and second-tier markets tend to be saturated, it is proper to obtain new increments from the sinking market.

Unique content+unique personnel design+compliance with the platform weather vane, Ran Hui’s fire explosion seems to be accidental, but in fact it is inevitable under the coupling of multiple conditions.

Ran Hui "runs wild" in the countryside, and the wanton time of herding sheep gives us a glimpse of the beauty of the Gobi countryside. However, the popularity of this kind of short rural videos has already shown signs. Bloggers who are famous for their rural themes, such as Li Ziqi, Grandma Pan, A Jun, Zhang Xue and Xiao Fanfan, have more than 10 million fans per capita in Tik Tok, and the countryside gives them many opportunities to be seen.

Grey Wolf’s sheep are popular, where is the short video of rural theme?

The popularity of @ Grey Wolf’s sheep makes us focus on the short video of rural theme again. We can’t help but ask ourselves, why do we love the countryside deeply?

Can’t go back to the countryside, can’t let go of the memories.

Mr. Fei Xiaotong said at the beginning of "Native China""From the grassroots level, China society is rural".To abandon the prejudice against "native land", we must admit the correctness of this assertion. From the historical point of view of human development, prosperous modern urban civilization is built on the fertile soil of native land civilization, and "moving to another place" and "returning to the roots" all tell us about our attachment to this land at our feet. Today, people’s most straightforward and simple pursuit of a happy life can still be said to be "wife and children are hot kang heads" or "farmers, mountain springs and a little fields". Since the 19th National Congress of the Communist Party of China, the importance of "rural revitalization" has been frequently mentioned.Realizing rural revitalization is not only the mission of the party and the country, the proposition of the times, but also how to place "homesickness".

The generation that used to play in the countryside has already combed their hair like adults. Studying, working and living make us run towards the city. Ambition in all directions is considered as a symbol of promise, but nostalgia for the countryside is our background color.

The main audience of short videos is young and middle-aged people, most of whom have lived in rural areas. When time goes by, people will keep nostalgic.The countryside carries the collective memory of generations, and also projects people’s initial heart, and short videos are the catalyst to promote people’s nostalgia.In the short video of the countryside, we saw deja vu villages and past lives. What’s more, many villages have become cities, so childhood memories will remain in our minds forever. The place where I once fled desperately, I found in a trance that I could never go back. In the neon of the city, we can reminisce about the past through short rural videos before we can take the "time machine" to the past.

For those who have never been exposed to this kind of life, this is a novel existence, and they may have expectations for another life in their hearts.No matter what kind of people, the short rural videos well meet people’s expectation of "living elsewhere".From Li Ziqi’s poetic and exquisite pastoral life, Zhang’s original solitary daily life to Ran Hui’s wild and gentle herding time, the rural culture space carrier is always easy to evoke people’s feelings. Through the short video of rural areas, we have completed the recollection of farming civilization, and then released the local plot in our hearts.

Get rid of the shackles of anxiety, entertainment and cure coexist.

Compared with the local plot, urbanization has profoundly affected each of us. Learning to adapt to the fast-paced and high-pressure urban life seems to be a compulsory course for everyone. The high-density information flow always conveys anxiety to us intentionally or unintentionally, while the short rural video provides nutrients to alleviate modern people’s mental anxiety and constructs a short dream for us.

It is not difficult to find that rural videos always reveal a carefree spirit, which is in sharp contrast with the tense and complicated urban life. The natural intimacy of the country allows people to stay away from the vortex of anxiety for a short time, and people feel cured while teasing the carnival. Whether it’s exquisite and quaint country houses, steaming home-cooked dishes, playful parent-child time, rough and natural shepherd life or short and trivial daily life of parents, all these are enough to show the villagers’ enthusiasm for life, and even the imperfect "running account" life record makes the real appearance of the local people even more precious.

More and more people flock to the country track, and the multi-angle interpretation allows us to find the country in our memory.Parents are short, quiet and comfortable, and steaming. This is the beauty that we may not be able to observe in it, and it is also the most warm gift left by our quietly lost childhood.

The reason is that the popularity of rural short videos is that they cater to people’s inner local feelings. There is a vast rural area in our country, and the villagers just take a picture of the scenery, which shows the humor different from the urban scenery. On the other hand, the countryside also corresponds to health and nature. After the vigorous urbanization movement, people are more and more eager to return to the original life, but the countryside in memory has either disappeared or is difficult to return. People reminisce about the past in short videos and reconstruct their own rural memories.

The popularity of rural short videos doesn’t start with Ran Hui, and it won’t end with her. Since this kind of theme is popular with the public, how can it help thousands of "distant" villages in Qian Qian?

How to continue the story after the explosion?

The fire in online celebrity is often only a flash, but the rural culture behind them needs to be seen for a long time. On August 29th, 2022, Yuli County held a media forum in online celebrity, in which "Alimu in the Territory" and "Sheep of Big Big Wolf" were invited to participate. The meeting emphasized the need to use the online celebrity effect to promote the beautiful food, famous and special products in hometown and create a "punching place in online celebrity". Behind the huge traffic lies the expectation of hometown development, but the popularity of the Internet is always fleeting, and whether the traffic can be turned into power remains to be verified.In the case that the country track is gradually crowded and the homogeneous content is constantly emerging, the audience will inevitably have aesthetic fatigue, and the moment after the wind blows, the real power competition will be ushered in.

△ Image source: Voice of Bazhou Cultural Travel

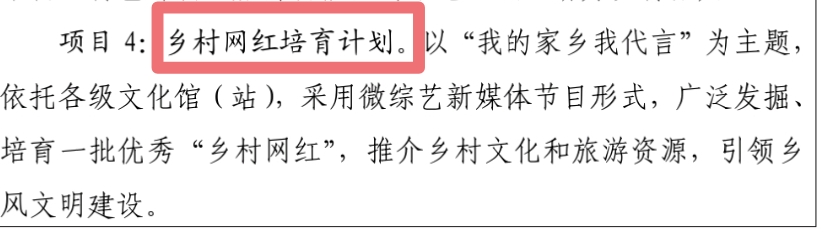

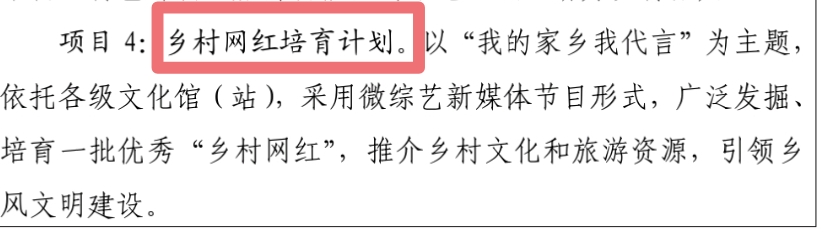

In 2021, the Ministry of Culture and Tourism issued the Plan for the Construction of Public Cultural Service System in the Tenth Five-Year Plan (hereinafter referred to as the Plan), which clearly put forward the cultivation plan of "Rural online celebrity". Policy endorsement means that the strength of rural online celebrity is recognized and they will have the opportunity to provide more value in the public cultural service system.

It is difficult to support a single tree. To achieve this goal, we need the support of many parties. As far as rural online celebrity is concerned, they need to deeply understand the texture of rural culture and immerse themselves in the countryside to find what the public likes; As far as the government is concerned, it is necessary to control the overall creative direction, eliminate those acts of malicious uglification and curiosity about rural culture, and create a healthy environment for the spread of rural culture; As far as the short video platform is concerned, it is a burden for the platform to formulate a detailed rural revitalization plan and give traffic, funds and technical support. In this process, it is important for Do not forget your initiative mind to truly take root in the local culture, so as to establish a good model rural cultural brand.

The popularity of rural short videos has made more and more people understand the charm of the countryside, and promoting rural revitalization and inheriting rural culture has also become the meaning of the title.But revitalizing the countryside is not to get rid of the countryside, but to expect generations of people to live and work in this land and write a new blueprint for the countryside in the new era.

References:

1. Zhizhu. com (Qiu Qiusheng): "Big Wolf’s Sheep" became popular: digital habitation between urban and rural areas, cyber rest inside and outside the besieged city.

2. Poisonous eyes: From Li Ziqi to the sheep of Big Big Wolf, the countryside is the traffic password of short video.