Anti-fraud early warning | case analysis of the latest electronic fraud means!

Recently, the new fraud of "online fraud+offline money withdrawal" is rampant. Xiao An analyzes a real case to analyze this new type of electric fraud case routine for you:

On August 28th, a district public security organ received an alarm from the victim Li, saying:

In July, I met a male netizen who claimed to be a "soldier" on Tik Tok. After a period of chatting, the other party asked Li to help manage an account in an investment and financial platform named "China Aerospace" on the grounds that it was inconvenient to operate due to a task.

1. Asking the victim to help manage the account is a common trick in telecom fraud, such as false investment and wealth management, "killing pig plates", etc. This kind of asking for help is easy to make the victim put down his guard and think that the operation on behalf of him is risk-free. In fact, the real purpose of asking the victim to help manage the account is to let the victim see the financial data with his own eyes, "seeing is believing" and trick him into believing in the "authenticity" of the false investment platform.

During Li’s help operation, he saw that the account had gains and losses every day. On the whole, the gains far exceeded the losses, and the trend of "steady profit" was obvious. So Li believed the netizen’s story and thought that the platform was a good platform that could really bring him benefits, and the psychology of wanting to invest together began to work.

Second, the victim’s "greed for profit" psychology is often used to the maximum extent. Criminals convince the victim to believe the so-called off-line special channels to recharge money by "evading fund supervision, special channels to deposit money, and tax avoidance". Then make up various reasons to induce the victim to go to the bank counter or withdraw money in batches at the ATM, and then give it to the stranger designated by the other party to take it away, causing great losses to property!

Under the further deception of the strange man, Li invited friends to download the platform and "invest" together. The other party then asked Li and his friends to withdraw cash in batches at the bank counter or ATM machine on the grounds of "evading fund supervision, tax avoidance, and recharging through special deposit channels", and handed over more than 1 million yuan in cash to the stranger designated by the other party (the criminal suspect responsible for taking the cash) to take it away.

1. Hide the whereabouts of funds.

2. Save the cost of capital transfer.

It is extremely risky to trust the investment and financial statements of strangers on the internet and then take cash to strangers! ! !

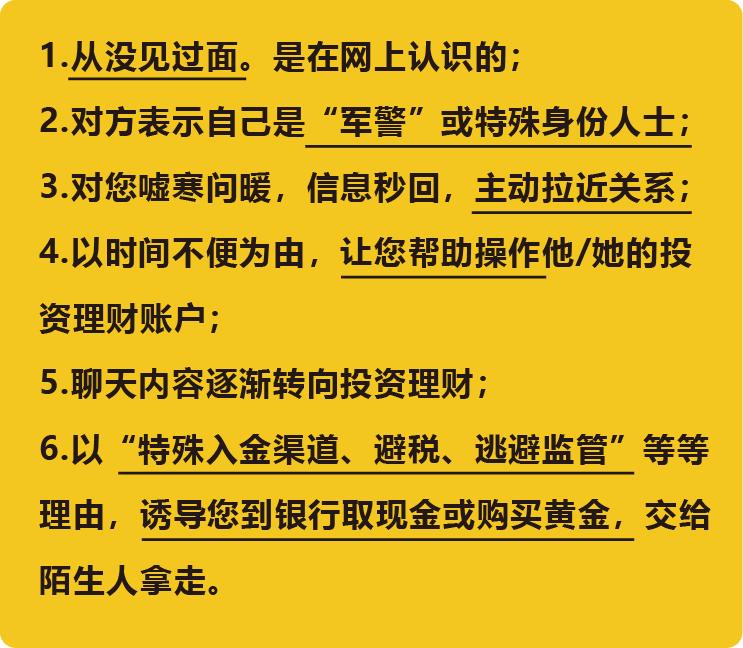

If you are in contact with strangers on the Internet and have the following characteristics, please be vigilant! Nine times out of ten, you have encountered telecommunication network fraud!

In case of strange online communication behavior, please take a look at the key points we have drawn to improve the ability to know and prevent fraud! ! ! If you are in doubt, please go to the nearby public security organ or call the 96110 national anti-fraud hotline for consultation and alarm! ! !

Source: Guizhou Anti-fraud Center

Editor: Ding Pan

First trial: Su Wei

Second trial: Luo Xingmei

Third trial: Luo Hua

Chief producer: Luo Shiming

Continue to slide to see the next touch to read the original text.

Puding melting medium slides up to see the next one.

Original title: "Anti-fraud warning | Case analysis of the latest electronic fraud means! 》

Read the original text